In our first two posts here and here about backwardation we described the fundamental meaning of an IVX backwardation. Namely that it hints markets participants may be beginning to panic.

In that sense we noted that it can be used as a risk mitigation tool, understanding the distributions of returns for the stock market and volatility when the futures are backwardated and when they are not. We noted that you should…

“Pay attention to VIX backwardations, but combine it with other tools to help you understand if you are bottoming (2013 to 2014 and 2017), or if you are about to get your ass handed to you (2011, 2015/2016, 2018 and 2019).”

Asses were indeed handed in March.

Since those posts, the curve has come down considerably – but has remain backwardated – indicating persistent skepticism / panic among market participants.

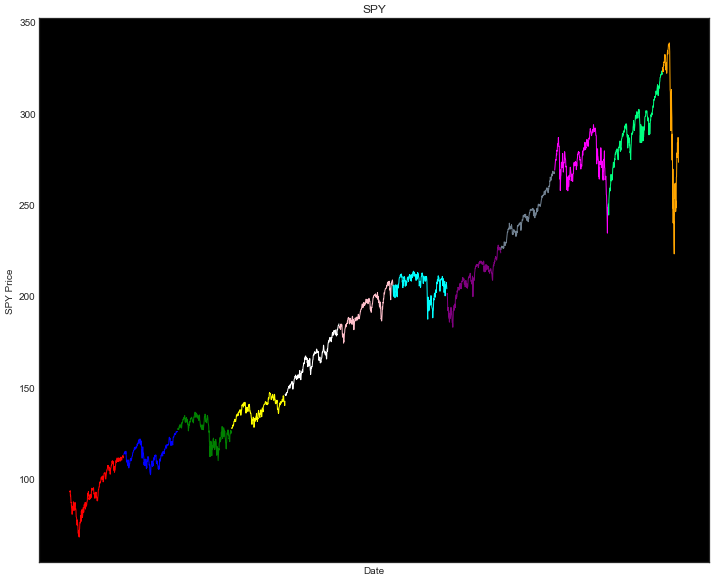

In this post we present the volatility term structure, day by day for each since starting in March of 2009.

In doing so, this will help us understand the shape of the term structure in different environments. First we present a chart of the S&P500 ETF (SPY) for each of the time periods covered. We show this chart as a legend for the video that comes next.

SPY Price Chart

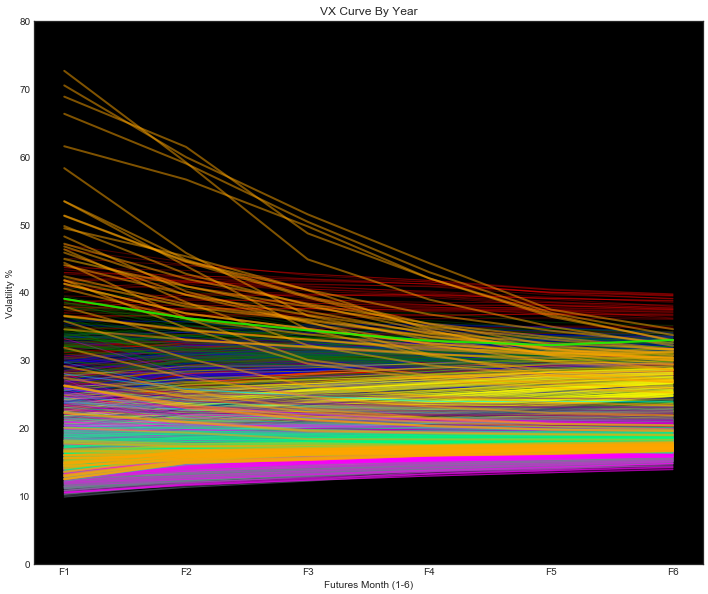

Next, the below chart shows each VIX futures curve from March 2009 to April 20, 2020, with the green line being the close on April – a bit of a mess, as such… our short (1m50s) video will take you day by day from then, until now (lime green curve).

VIX Curve By Year

So… Kick back, relax and enjoy the banjo as I rapidly toss colorful lines (VIX Curves) into your eyeballs.

What do we take-away (in general)? Risk on years (2010, 2012-late 2015, 2017, 2019) generally have very low curves that are upward sloping. Risk off years have high curves that slope downwards (VIX backwardation).

The VIX curve (as of today) is suggesting that we are not out of the woods, and as a risk management tool, we believe it is worth continuing to pay attention to.

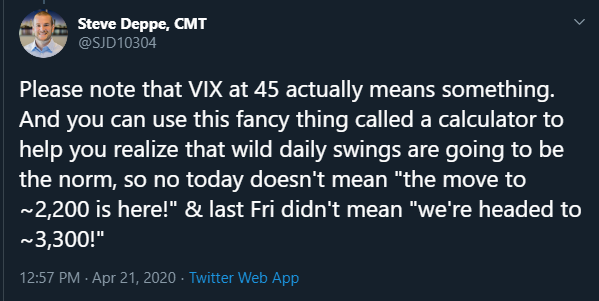

With that we leave you with some not irrational market prophecy from Steve Deppe.

Thanks, we hope you enjoyed this post. Please check out riskdials.com and the Private Lunch – a is a research tool that helps quantify S&P500 market risk. And.. follow us on Twitter @discdystopia

Until next time.