In our last post, https://www.discretionarydystopia.com/liquidity-risk-pt1/ we highlighted how liquidity risk relates to our every day lives. In this post we define liquidity in the markets and explain how it can be used to gauge the actions of market participants.

What is Liquidity?

Liquidity in the markets is, “… the ability to trade large size quickly, at low cost, when you want to trade. It is the most important characteristic of well-functioning markets.” – Larry Harris.

Perfect, now we know what liquidity is… but as investors, traders and risk managers, we need to be able to measure liquidity so that we can use that information to make better decisions.

How to Measure Liquidity

Many academics have attempted to pioneer the measurement of liquidity in markets – but probably the simplest and most logical method (imo) was devised by Professor Amihud.

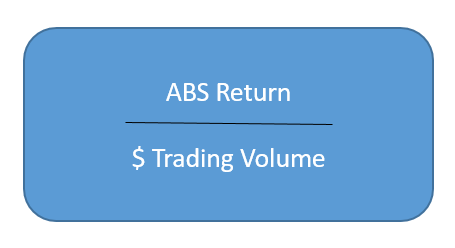

In summary of Yakov’s paper*, liquidity can be measured as the absolute price change in % per $ of volume.

Sum this measure up for each S&P500 stock and you have an index measure for liquidity.

Average or take a percent rank over a certain time period and now you have a really good idea if a given day is liquid or illiquid relative to you chosen time period.

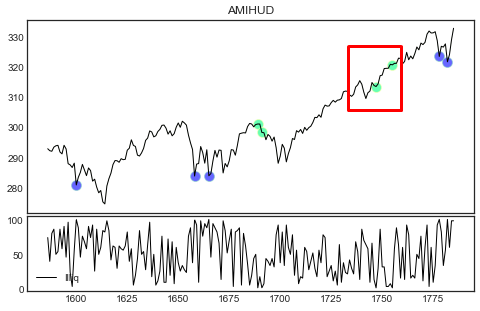

A modified Amihud Ratio simply takes a 50 day percent rank. 1st and 99th percentile readings (Green – very liquid and Blue – very illiquid, respectively) produce the following chart:

Liquidity Risk

Bottoms are often preceded by 99+% readings (everyone panics at the same time). Tops are often (though psychologically much different (more false positives)) preceded by 1+% readings. The most recent 99% reading? Friday January 31st, 2020. Today? All Time Closing Highs.

How does this relate to our posts on volatility? It is very simple. When you have volatile conditions you are likely to experience illiquid conditions and vise-versa.

In summary of this post and in re-iteration of our first post:

You want liquidity. “Everyone likes liquidity” – Larry Harris.

The difference between real life and markets is that when you hit extremes in markets mean reversion has been consistently observed (people have a vested interest in their country’s economy).

If this has peaked you interest take a look at www.riskdials.com.

The risk and investment model is built purely with the intent to measure relative asset class liquidity and keep you invested when liquidity is plentiful, and defensive when it is not.

It has been created through the experiences of a 35 year investment and trading career. The Private Lunch looks at short term metrics and will identify when trends may be at risk of exhausting themselves.

Thanks!

If you enjoyed this post, follow us on twitter @discdystopia and subscribe for email updates (top right).