This article builds on our article on backwardation. In particular it elaborates on what volatility means at a transactional level for the stock market.

Like the last article I will try to explain liquidity risk in a way that you can relate to.

To YOU:

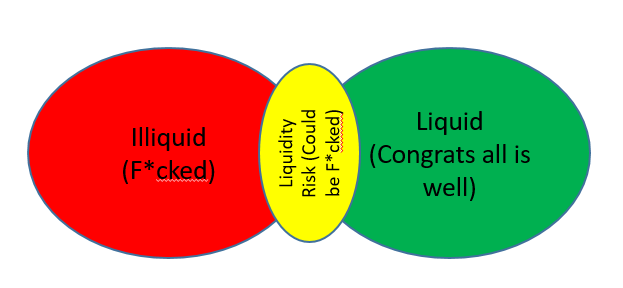

Liquidity is the availability of money and the freedom to execute transactions when you want. You can cover your discretionary and non-discretionary expenses – and you can cover unforeseen expenses.

If you are Illiquid, you could have potentially:

- Lost your job (a liquidity event)

- Accumulated a significant amount of debt that you cannot service.

- Failed to save any money.

If you are personally illiquid, you are consistently searching for liquidity (like everyone else), but with a certain urgency.

If you have a job (1) but you have a significant amount of debt (2) and failed to save any money (3) you have high liquidity risk. You are short convexity and f*cked if anything goes awry.

You want liquidity. “Everyone likes liquidity” – Larry Harris.

In the next post we will define liquidity in the markets and explain how it can be measured and used to determine internal market conditions.